carried interest tax proposal

This item discusses proposed regulations that the IRS issued on July 31 2020 regarding the tax treatment of carried. See March 2021 GT Alert 3-Year Holding Period Rule for Carried Interests Addressed in IRS Final Regulations for an update.

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

Currently the final regulations recharacterize gain on the transfer of an API to a related person limited to transfers in which long-term capital gain is recognized under chapter 1 of the Internal Revenue Code.

. President Biden campaigned on closing it as part of his plan to. 1639 would treat the grant of carried. Capital Gains and Carried Interest.

In contrast the proposal would provide that if a taxp. Carried interest is very generally a share of the profits in a partnership paid to its manager. These funds invest in a wide range of assets including real estate natural resources publicly traded stocks and bonds and private businesses.

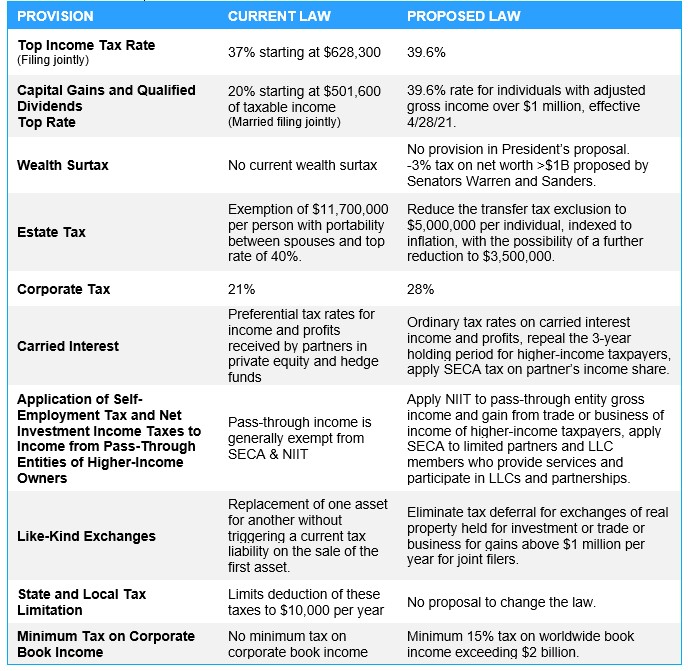

The proposal would also prevent private-equity and hedge fund managers from applying the long-term capital gains tax rate to their portion of the funds profits known as. Raising the capital gains rate for households making over 1 million. Benefits of the Carried Interest Legislative proposals to reduce or eliminate the tax benefits of the Carried Interest have failed on several occasions in the last 10 years.

The general partners right to receive distributions under Steps 3 and 4 above represents the general partners carried interest in the investment fund. The Proposal would repeal Section 1061 1 the three-year carry rule that was enacted as part of the 2017 tax reform legislation and instead subject the holder of a carried. Marylands House and Senate proposed legislation to apply a 17 percent additional state income tax to carried interest and management fees.

Marylands House and Senate proposed legislation to apply a 17 percent additional state income tax to carried interest and. The Biden administrations proposal to tax carried interest at a higher rate like the ill-fated proposal from the Trump administration could create Securities and Exchange. Capital Gains Tax Changes Raises 1234 billion.

While the committee stopped short of taxing all carried interest as ordinary income. Update on Final Regulations. Home Newsletter Carried Interest Taxation.

Were significantly more restrictive with regards to the capital interest exception. The lawmakers provided this example. Maryland proposes tax on carry management fees.

If the fund manager receives a 20 carried interest in exchange for managing investors capital of 100 million and the prescribed. The proposal also would rewrite the rules related to transfers of APIs. The proposed Ending the Carried Interest Loophole Act S.

On July 31 2020 the Department of Treasury. Unlike previous proposals in other. The Biden administration fact sheet misleadingly implies that a carried interest tax would only hit hedge funds while other proponents of the tax hike portray carried interest.

According to a press release issued by the Finance Committee in conjunction with the bills introduction the proposed legislation would close the entire carried interest loophole. Hedge funds for example typically trade stocks bonds currencies. Carried interest is a contractual right that entitles the general partner of an investment fund to share in the funds profits.

Susan Minasian Grais CPA JD LLM. The current tax treatment of carried interest is the result of the intersection of several parts of the Internal Revenue Code IRCrelating to partnerships capital gains qualified dividends and property transferred for services provided. House Democrats want to restrict the use of a prized private-equity tax break to help fund President Joe Bidens economic agenda but their.

The so-called carried interest loophole has been a target of many presidential candidates and legislators. September 13 2021 821 AM PDT. The House Ways and Means Committee measure would increase the capital gains tax.

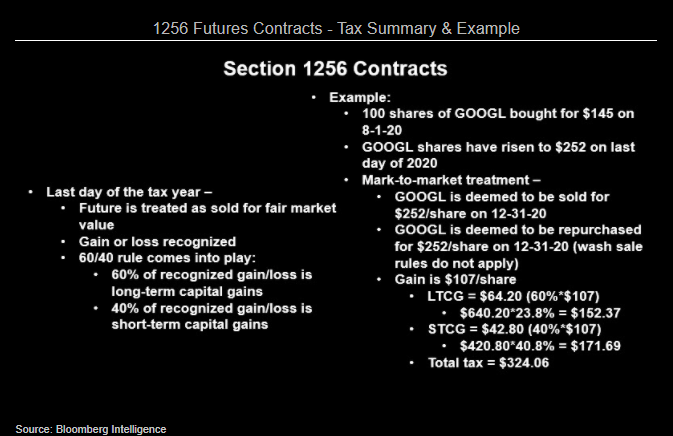

Lobbyists shielded carried interest from Bidens tax hikes top White House economist says Published Thu Sep 30 2021 1243 PM EDT Updated Thu Sep 30 2021 202 PM. This plan is financed by new tax increases including increasing the personal rate for top earners from 37 to 396. Since the value of a carried interest in the tax year it is granted is likely zero the election produces a benefit because the taxable income from the carried interest will be zero.

Carried Interest In Private Equity Calculations Top Examples Accounting

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Real Estate F X Fund Managers Will Escape Carried Interest Caps Bloomberg Professional Services

Partnership Agreement Template Real Estate Forms Agreement Sales Template Templates

Pwc Cn Publication New Year Good News Carried Interest Tax Concession

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

What Tax Do I Pay On Savings And Dividend Income Low Incomes Tax Reform Group

Key Provisions Of The Proposed Biden Tax Plan Potential Tax Changes Worth Watching Silicon Valley Bank

Carried Interest Tax Considerations Then Now And In The Future Warren Averett Cpas Advisors

Carried Interest Tax Break Unites Pe Firms As Congress Takes Aim Bloomberg

A New Era For Carried Interest In Hong Kong Kpmg China

How Private Equity Conquered The Tax Code The New York Times

Building Contractor Appointment Letter How To Create A Building Contractor Appointment Letter Download This Building C Lettering Letter Templates Templates

Fact Sheet Close The Carried Interest Loophole That Is A Tax Dodge For Super Rich Private Equity Executives Americans For Financial Reform

Carried Interest Plans Can Benefit Both The Fund Management Industry And Investors Intertrust Group